8049771878: What You Need to Know About Dividend Stocks

Dividend stocks offer a unique investment avenue characterized by their ability to provide regular income through dividends. While they present advantages like consistent cash flow, they also come with inherent risks, including fluctuating payments. Understanding the balance between potential rewards and drawbacks is essential for investors. The key lies in careful selection and ongoing evaluation. What factors should one consider when navigating the world of dividend stocks?

Understanding Dividend Stocks

Understanding dividend stocks involves recognizing their significance as a form of investment that provides regular income to shareholders.

Key metrics such as dividend yield and payout ratio are essential in evaluating these stocks. The dividend yield indicates the return on investment through dividends, while the payout ratio reflects the proportion of earnings distributed as dividends, guiding investors in assessing the sustainability of their income.

Advantages and Disadvantages of Dividend Investing

While dividend investing offers a reliable income stream, it is essential to weigh both its advantages and disadvantages.

On one hand, dividend stocks provide income stability and potential for long-term growth, appealing to risk-averse investors.

Conversely, reliance on dividends may limit exposure to high-growth stocks, and fluctuating dividend payments can impact cash flow, necessitating careful consideration of individual investment goals.

Tips for Selecting the Right Dividend Stocks

Selecting the right dividend stocks requires a strategic approach that balances income potential with overall portfolio goals.

Investors should prioritize stocks with a sustainable dividend yield and a manageable payout ratio, indicating that the company can comfortably distribute profits without jeopardizing growth.

Analyzing historical performance and industry stability further aids in making informed decisions, ensuring a reliable income stream while fostering long-term financial freedom.

Conclusion

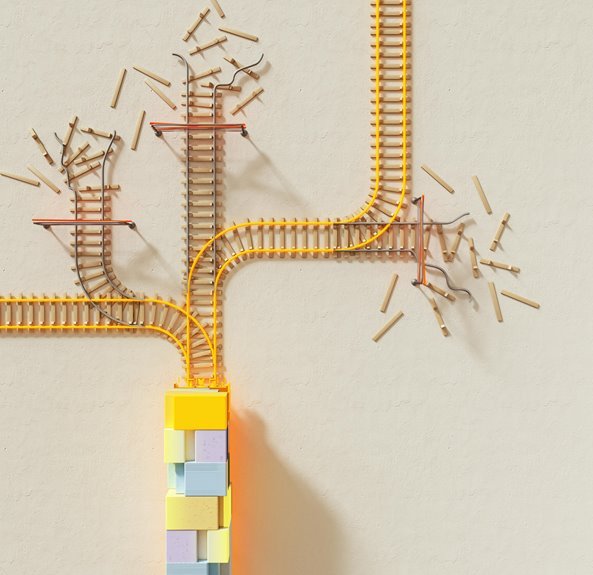

In conclusion, while dividend stocks may seem like golden geese, investors must remember that even the most reliable bird can occasionally fly south. The allure of steady income and long-term growth is tempting, yet the lurking risks of fluctuating payouts and missed opportunities in the fast-paced market can leave some investors clutching their pearls. Thus, a discerning eye and a cautious approach are essential, lest one finds themselves in a nest of unanticipated disappointments.