4123859473: Top Performing ETFs of the Year

The analysis of the “Top Performing ETFs of the Year” reveals critical insights into their metrics and overall market performance. With a focus on Key Performance Indicators, these funds showcase low expense ratios and robust returns. Additionally, sector analysis indicates the underlying forces propelling their success. Understanding the investment strategies employed by these ETFs may provide valuable perspectives for those looking to optimize their portfolio. What specific strategies set these funds apart from the rest?

Key Performance Indicators of Top ETFs

Key performance indicators (KPIs) serve as critical metrics for evaluating the success of exchange-traded funds (ETFs), particularly in a competitive investment landscape.

Essential performance metrics include expense ratios, historical returns, and tracking errors, which facilitate fund comparisons.

Sector Analysis: Driving Forces Behind Success

While various factors contribute to the success of top-performing ETFs, sector analysis emerges as a fundamental component that can illuminate underlying trends and catalysts.

Examining specific sectors reveals how economic factors, such as consumer spending and interest rates, shape market trends.

This analytical approach allows investors to identify sectors poised for growth, ultimately enhancing portfolio performance and fostering informed investment decisions.

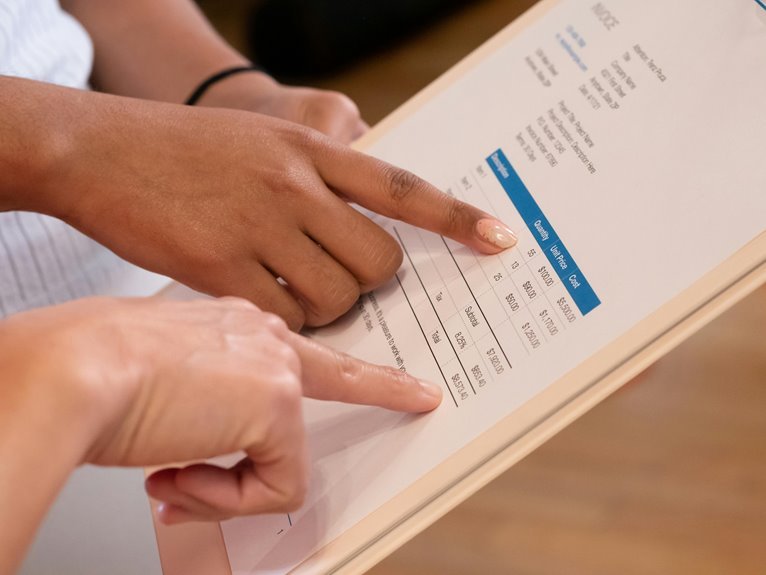

Investment Strategies of High-Performing ETFs

Numerous investment strategies underpin the success of high-performing ETFs, each tailored to leverage specific market conditions and investor sentiments.

Fundamental approaches often emphasize dividend growth, attracting income-focused investors. Additionally, robust risk management techniques are crucial, enabling these ETFs to navigate volatility while maintaining performance.

Conclusion

In conclusion, the top-performing ETFs of the year stand as beacons of strategic investment, illuminating the path for investors navigating the turbulent seas of the market. With their robust performance metrics and insightful sector analyses, these funds demonstrate that a keen understanding of market dynamics can turn potential pitfalls into profitable opportunities. As investors sift through the data, these ETFs serve as guiding stars, highlighting the importance of informed decision-making in portfolio enhancement.